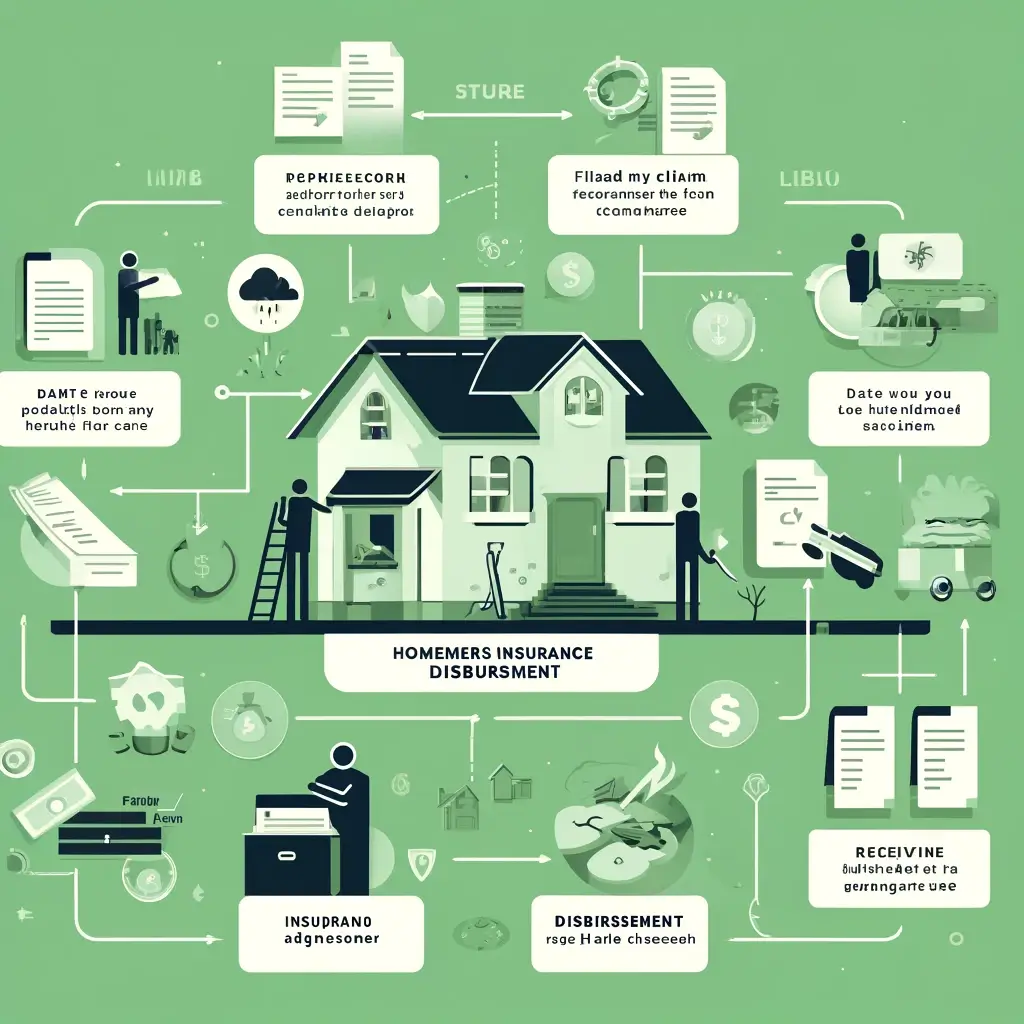

Understanding how disbursements work in the realm of homeowners insurance can often feel daunting. At Carvo Insurance Group, we aim to make every aspect of homeowners insurance transparent and easy to manage. This includes offering instant online quotes, instant online binding, and instant online insurance proposals, all designed to streamline your insurance experience. In this blog post, we’ll address some frequently asked questions about homeowners insurance disbursement to help you better understand this critical process.

Q1: What is homeowners insurance disbursement?

A1: Homeowners insurance disbursement refers to the process by which your insurance company pays out funds for a claim you have filed. This could be for repairs to your home after a covered loss, replacing personal belongings, or even covering living expenses if your home is uninhabitable during repairs. The disbursement is made directly to you, the policyholder, or in some cases, directly to the contractor or other service providers.

Q2: How does the disbursement process work?

A2: After a claim is filed and assessed, the insurance company will determine the amount of money required to cover the claim based on the terms of your policy. The disbursement process typically involves the following steps:

- Claim Assessment: An adjuster will assess the damage and estimate the repair costs.

- Claim Approval: Once the claim is approved, the insurance company will issue a payment based on the policy’s coverage details.

- Funds Disbursement: The funds may be disbursed in a single payment or in multiple payments, especially for larger or ongoing repair work.

Q3: What factors can affect my insurance disbursement?

A3: Several factors can impact the timing and amount of your disbursement:

- Deductible: Your policy’s deductible amount must be paid before any disbursement can be made.

- Coverage Limits: The maximum payout for a claim is determined by your policy’s coverage limits.

- Claim Details: The complexity of the claim, accuracy of the report, and required documentation can all influence how quickly disbursements are made.

Q4: How can I ensure a smooth disbursement process?

A4: To help ensure a smooth disbursement process, consider the following tips:

- Prompt Claim Reporting: Report any damage as soon as possible to expedite the claims process.

- Documentation: Keep detailed records and receipts for any repairs or replacements.

- Communication: Stay in regular contact with your insurance adjuster to keep abreast of any updates or additional requirements.

Q5: How does Carvo Insurance Group facilitate the insurance disbursement process?

A5: At Carvo Insurance Group, we facilitate a streamlined insurance disbursement process by:

- Instant Online Insurance Proposal: Get detailed information on what your insurance covers and how disbursements are handled.

- Instant Online Quotes and Binding: Quickly start and finalize your insurance coverage online, ensuring that you are prepared before any loss occurs.

Call to Action

Ready to manage your homeowners insurance with ease? For a Home Owners Insurance Quote, click here.

At Carvo Insurance Group, we are committed to providing clarity and convenience in all aspects of homeowners insurance, including the disbursement process. By understanding these fundamentals, you can better navigate the complexities of insurance claims and ensure that you are adequately prepared to handle any situation that arises.