Surety bonds are a vital component in many business transactions, providing a guarantee that certain aspects of a contract are fulfilled. Whether you’re a contractor looking to comply with state regulations or a business owner needing to assure service quality, understanding surety bonds is crucial. At Carvo Insurance Group, we offer instant online quotes, instant online binding, and comprehensive online insurance proposals to simplify acquiring surety bonds. This blog post, presented in a question and answer format, explores the meaning and importance of surety bonds.

What is the meaning of a surety bond?

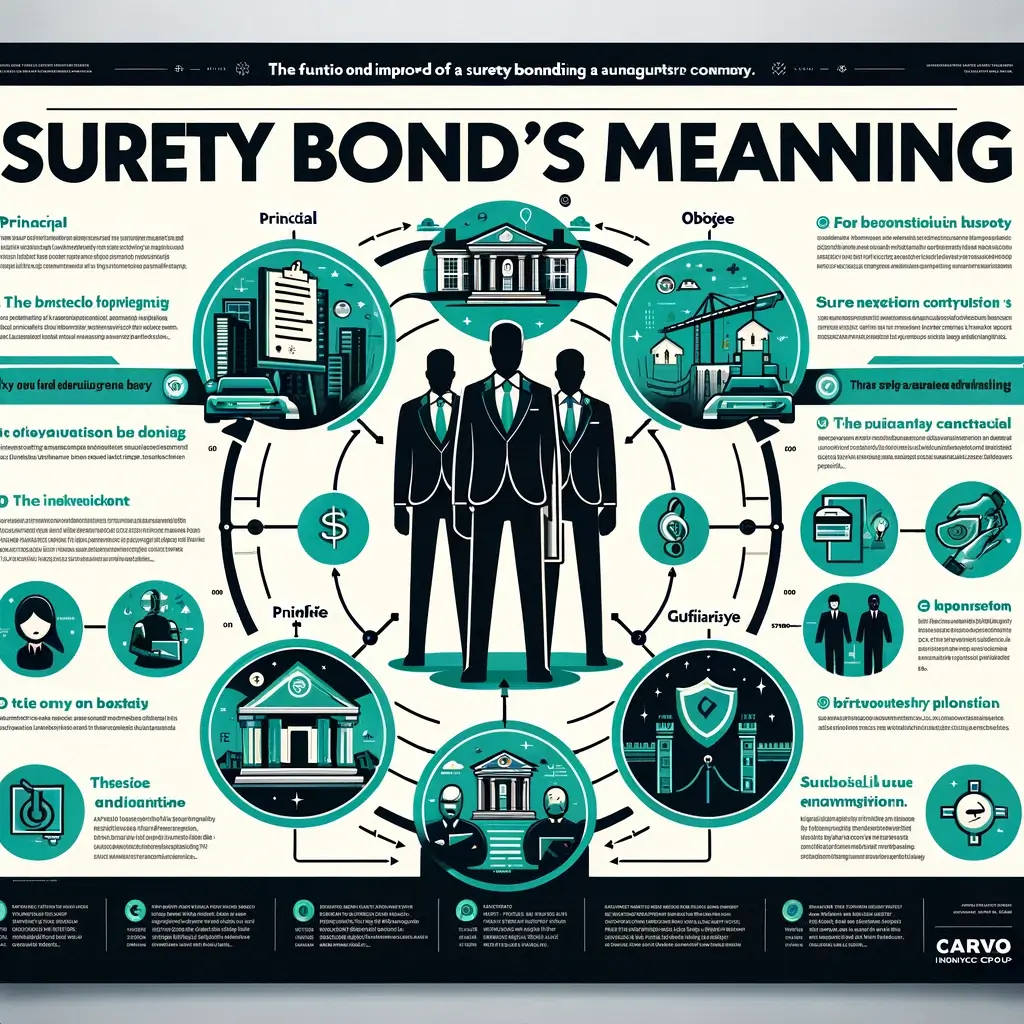

A surety bond is a three-party agreement where the surety (insurance company) guarantees to the obligee (the project owner) that the principal (the party performing the contractual obligation) will fulfill their duties specified in the bond’s terms. Surety bonds are commonly used to protect public and private interests from losses, ensuring that a contract is completed in accordance with its terms.

Who needs a surety bond?

Surety bonds are typically required in industries where compliance, performance, and financial risk are concerns, such as construction, auto dealerships, and public official positions. They are also essential for contractors bidding on government projects, businesses seeking to maintain professional licenses, or companies handling large transactions that require a guarantee.

How do surety bonds work?

The surety bond functions as a form of insurance where the surety company provides a financial guarantee to the obligee that the principal will meet their obligations. If the principal fails to fulfill their contractual duties, the surety may be required to compensate the obligee for any financial losses or arrange for the completion of the contract.

How can I get an instant online quote for a surety bond?

Carvo Insurance Group makes obtaining a surety bond straightforward and efficient. By visiting our website and providing some basic information about your business and the bond you require, you can receive an instant online insurance proposal. Our system allows you to quickly understand the costs and terms involved, helping you make informed decisions with ease.

What is the benefit of instant online binding for surety bonds?

Instant online binding offers the immediate effectuation of your surety bond once you accept the terms and complete the application. This feature is particularly beneficial for businesses that need a bond quickly to meet contractual or licensing requirements, ensuring there are no delays in starting your project or business operations.

Why choose Carvo Insurance Group for your surety bonds?

Choosing Carvo Insurance Group means working with a provider that understands the complexities of surety bonds and the industries they serve. We offer customized bonding solutions, backed by fast and reliable service, ensuring that you receive the bonds you need with minimal hassle and maximum efficiency.

For Surety Bonds Quote, click here: https://carvofinancialgroup.com/surety-bonds/.

Secure your surety bond with Carvo Insurance Group and enjoy the peace of mind that comes from knowing your project or business is backed by a robust guarantee. Utilize our online tools to get a detailed proposal today, and ensure your contractual obligations are safeguarded with the right surety bond.